January 27, 2022

On Jan. 10, 2022, Gov. Gavin Newsom unveiled the proposed state budget for fiscal year 2022-23. Two years into the COVID-19 pandemic and three years into Newsom’s term as governor, the budget features many proposals that directly respond to the present crisis created by the pandemic while also building upon priorities — many of which are related to early childhood — set by Newsom in his two previous budget proposals.

Dubbed “The California Blueprint,” the proposed budget is a $286.4 billion spending plan that features $45.7 billion in total budgetary surpluses and — after accounting for mandatory reserve fund transfers — $20.6 billion in discretionary funds. While the surplus is below last year’s record of $75.7 billion, it still remains high by historical standards. Furthermore, there is a potential that the surplus will rise even higher if economic activity increases. In June, California will also receive the second tranche of federal funding provided through the American Rescue Plan, providing even greater budgetary resources to the state, along with an additional $14 billion over the next five years through the recently passed federal infrastructure bill –– and potentially more if negotiations over federal Build Back Better legislation restart and eventually prove successful.

Newsom and state officials have noted that the budget is dubbed a “blueprint” because it is building off priorities set by the administration in previous years while also serving as the framework for creating a foundation to combat COVID-19 and other existing threats — such as climate change and homelessness — facing the state. Examples of priority-building in the early childhood arena include the expansion of the California Home Visiting Program’s capacity to serve diverse families, strengthening the state’s Public Health Infrastructure and Behavioral Health systems, training providers on Adverse Childhood Experiences (ACEs) and paying for developmental and ACEs screenings, hiring new community health workers, and funding the initial implementation of dyadic care services for children and families, as well as the California Advancing and Innovating Medi-Cal (CalAIM) reform effort.

Newsom and state officials have noted that the budget is dubbed a “blueprint” because it is building off priorities set by the administration in previous years while also serving as the framework for creating a foundation to combat COVID-19 and other existing threats — such as climate change and homelessness — facing the state. Examples of priority-building in the early childhood arena include the expansion of the California Home Visiting Program’s capacity to serve diverse families, strengthening the state’s Public Health Infrastructure and Behavioral Health systems, training providers on Adverse Childhood Experiences (ACEs) and paying for developmental and ACEs screenings, hiring new community health workers, and funding the initial implementation of dyadic care services for children and families, as well as the California Advancing and Innovating Medi-Cal (CalAIM) reform effort.

The health and economic consequences of the pandemic continue to represent an urgent crisis for many families in California, disrupting the stability of children and families across the state, especially now as the delta and omicron variants spread faster than ever. Newsom’s January budget seeks to address this through a $2.7 billion COVID-19 relief package that includes $1.4 billion in immediate emergency spending to quickly increase vaccine distribution efforts, expand testing capacities, and expand staffing and capacity at state emergency response agencies.

Like all blueprints, however, the outline may look different when realized, and the details of the proposal are subject to change. Newsom himself has emphasized that the fiscal estimates related to the surplus levels, and even specific funding proposals, would likely change in the forthcoming May Budget Revise. This leaves First 5 LA and other partners in the field of early childhood advocacy with a key opportunity to inform and shape the next round of budget items while advocating that leaders utilize this singular period of surplus to promote equity and to fully support children and families facing ongoing crises resulting from the pandemic.

For example, the second year of surplus revenue projections means California has another critical opportunity to build more effective and equitable public systems. While the January budget proposes important investments in systems that support families and young children, a one-time, short-term investment is not enough. Rather, California must use the resources it has today to improve family-serving systems and make them work better over the long term. Moving toward the scheduled update of the budget proposal in May, it is critical that Newsom and lawmakers more fully acknowledge and respond to the challenges facing families in L.A. County and throughout California, especially Black, Indigenous and people of color living in those communities impacted the most by COVID-19.

While the January proposal does include crucial investments in reimbursement rates for early learning providers and in additional supports statewide, with a focus on areas with limited or no access to child care, the levels of funding are not sufficient to meet the needs of every California family. Throughout the pandemic, thousands of child care providers have had to shut down, preventing families from finding care, depriving young children of critical early learning opportunities, and causing uneven and inequitable economic recovery across the state. Providers that have remained open through this time have struggled to stay operational, keeping up with ever-changing health and safety protocols, absorbing the increased costs to manage and keep their facilities clean, and dealing with record-low enrollment rates that make it financially difficult to continue providing services. Central to an equitable, accessible and quality early learning system is a trained early educator workforce that receives full reimbursement for the true cost of caring for young children. To make this workforce a reality, ECE supporters must advocate for fully investing in and intentionally building out California’s mixed delivery system for early learning in the May Revise. This must be a major focus of state leaders going forward.

Additionally, last year’s budget provided most Californians with at least $600 and up to $1,100 as part of a statewide stimulus plan. But the 2022-2023 budget proposal does not include additional direct financial relief for families through the Golden State Stimulus program. Newsom, however, did say projections indicate the state will breach statutory spending caps set by Gann Limit, which would trigger a mandatory transfer of excess revenues to the state’s education system and to taxpayers. As a result, families are likely to receive some form of direct financial support in 2022, with Newsom saying he would provide more detail in the May Revise after consulting with the Legislature and accessing updated state revenue estimates. This is another indication that this budget proposal will potentially see major changes in May.

Finally, the budget proposal stated the administration’s support for reforming California’s cannabis tax policies; however, there is currently no language indicating what the administration is prioritizing or how the tax structure could change. Instead, the budget simply says the administration will work with the Legislature on making modifications. California currently projects $787 million in cannabis tax revenue in 2022-2023.

Overall, First 5 LA’s broad advocacy strategy through the budget development process will focus on educating policymakers on the need to prioritize long-term improvements in essential child-serving infrastructures and systems and to ensure that families face fewer barriers to accessing supports. First 5 LA will also help policymakers connect disparate funding streams provided in this budget proposal to promote greater alignment and integration across systems that impact child health and development.

The key highlights of Newsom’s 2022-2023 January Budget Proposal related to First 5 LA’s priorities include:

Children have high quality early care and education experiences before kindergarten.

The proposed budget includes:

- $1 billion to implement the first year of Universal Transitional Kindergarten (UTK), with full implementation by 2025-26. Aligning with the goals of the Master Plan for Early Learning and Care, the proposed budget continues to support last year’s major investments in UTK expansion and is expected to increase access to early learning for at least 56,000 young children across California in 2022-2023. This proposal includes:

- $639.2 million to expand UTK eligibility to all children who turn 5 between Sept. 2 and Feb. 2, beginning in the 2022-23 school year.

- $383 million to add an additional educator to every transitional kindergarten classroom to help reduce the ratio of students to adults in UTK classrooms.

- $373 million to help subsidize a full year of rate increases for providers while the state continues to work toward comprehensive rate reform in alignment with the goals set out in the Master Plan for Early Learning and Care. This builds upon investments made in last year’s budget and strongly aligns with First 5 LA’s priority to ensure providers receive fair pay to meet the true cost of care.

- Child Care Providers United (CCPU), through the Joint Labor Management Committee (JLMC), is currently developing recommendations on streamlining the state’s reimbursement structure; these are set to be made available by Nov. 15, 2022. Additionally, a state workgroup tasked with assessing the methodology for establishing reimbursement rates will provide its findings by Aug. 15, 2022.

- $823.7 million for 36,000 additional subsidized child care spaces, bringing the total to just over 145,000 spaces statewide. Multi-year investments, provided through the 2021 state budget, went into effect this year, with the goal of bringing this total up to 200,000. While that is a positive step, it is still not enough to properly address California’s child care crisis.

- Other investments to expand child care include $25 million to fund the Child Care Initiative Project through June of 2023. This is intended to increase spaces in high-need areas and support providers in those communities that want to become licensed.

- $308.4 million to ensure California State Preschool Program (CSPP) meets the needs of students with disabilities and dual language learners. New requirements for CSPP providers stipulate that they must serve at least 10 percent of students with disabilities and provide additional supportive services for dual language learners.

- Moreover, this budget proposal looks to expand eligibility for all students participating in CSPP from 12 to 24 months. Children with an individualized education program (IEP) would be considered eligible to participate in CSPP, and CSPP providers that have served all eligible 3- and 4-year-olds in their programs would be able to enroll 2-year-olds in their service as well.

- $4.8 million to support the initial infrastructure, planning and design of California Supporting Providers and Reaching Kids (CalSPARK), a data pipeline system focused on meeting the needs of providers and programs. CalSPARK is part of the California Department of Social Services’ (CDSS) Brilliant Beginnings hub for families seeking to access information about the child care landscape in their area.

- The proposed budget also includes $3.1 million from the 2020-2023 Preschool Development Grant Birth to Five Renewal to support the Brilliant Beginnings data initiative and the single verification hub.

Children receive early developmental supports and services, and are safe from abuse, neglect, and other trauma.

The proposed budget includes:

- $87 million ($41 million General Fund) to implement Dyadic Services effective Jan. 1, 2023. Dyadic care services provide integrated physical and behavioral health screening and services to the whole family, help increase access to preventive care, improve the coordination of care and maternal mental health, and strengthen the social-emotional health and safety of children.

- $350 million General Fund to recruit, train, and certify 25,000 new community health workers (CHWs) by 2025. Last year’s budget added CHWs to the list of skilled individuals allowed to provide Medi-Cal services; the state Department of Health Care Services (DHCS) plans to make CHWs available to beneficiaries starting on July 1.

- $400 million in one-time funding ($200 million General Fund) for Medi-Cal Provider Equity payments, to incentivize providers to focus on advancing equity and improving quality in children’s preventative health and maternal care services.

- $1.2 billion ($435.5 million General Fund) in 2021-2022, $2.8 billion ($982.6 million General Fund) in 2022-2023, $2.4 billion ($876.4 million General Fund) in 2023-2024 and $1.6 billion ($500 million General Fund) in 2024-2025 to implement the California Advancing and Innovating Medi-Cal (CalAIM) reform effort.

- $176 million in additional funding to support access to women’s health services and developmental and Adverse Childhood Experiences (ACEs) screenings. Providing payments through Proposition 56 to providers for conducting these early childhood screenings was a benefit first created in the 2020 state budget. In 2022-2023, these Medi-Cal supplemental payments are projected to exceed revenue by $176 million, necessitating this additional funding.

- $135.1 million over a three-year period to extend Medi-Cal provider training for conducting ACEs screenings.

- $100 million General Fund annually to strengthen the state’s public health infrastructure and complement local funding, especially for the purposes of improving collaboration between state and local governments entities. This money, on top of the $300 million provided annually through the 2021 state budget to invest in the state’s public health infrastructure, would support the establishment of an Office of Policy and Planning that would lead efforts to understand emerging public health threats, expand the public health workforce and enhance communication and public education efforts to combat mis- and disinformation.

- $10.6 million through June 30, 2023, for the California Infant and Early Childhood Mental Health Consultation program, to support the mental health needs of children, families and child care providers.

- $53.2 million ($18.9 million General Fund) in 2022-2023 and $89 million ($31 million General Fund) annually to reduce Medi-Cal premiums for approximately 500,000 pregnant women, children and disabled working adults. Currently, some beneficiaries earn incomes that are slightly above the threshold for receiving no-cost Medi-Cal, requiring them to pay monthly premiums.

Families optimize their child’s development

The proposed budget includes:

- $50 million ongoing to expand the California Home Visiting Program and Black Infant Health Program, provide greater flexibility in the home visiting models families can receive, and expand supports to additional counties.

- $200.7 million to increase by 7.1 percent the maximum level of CalWORKs cash grants families can receive. This higher level of aid would support family economic security, crucial for a family’s ability to thrive, especially as COVID-19 has disproportionately impacted those already at-risk. Economic stability and empowerment are important components to supporting the whole child and whole family as well. According to the Department of Social Services, the final Maximum Aid Payment amount could change in the May Revise based on available funding.

- Several items related to early intervention and the state’s regional center system:

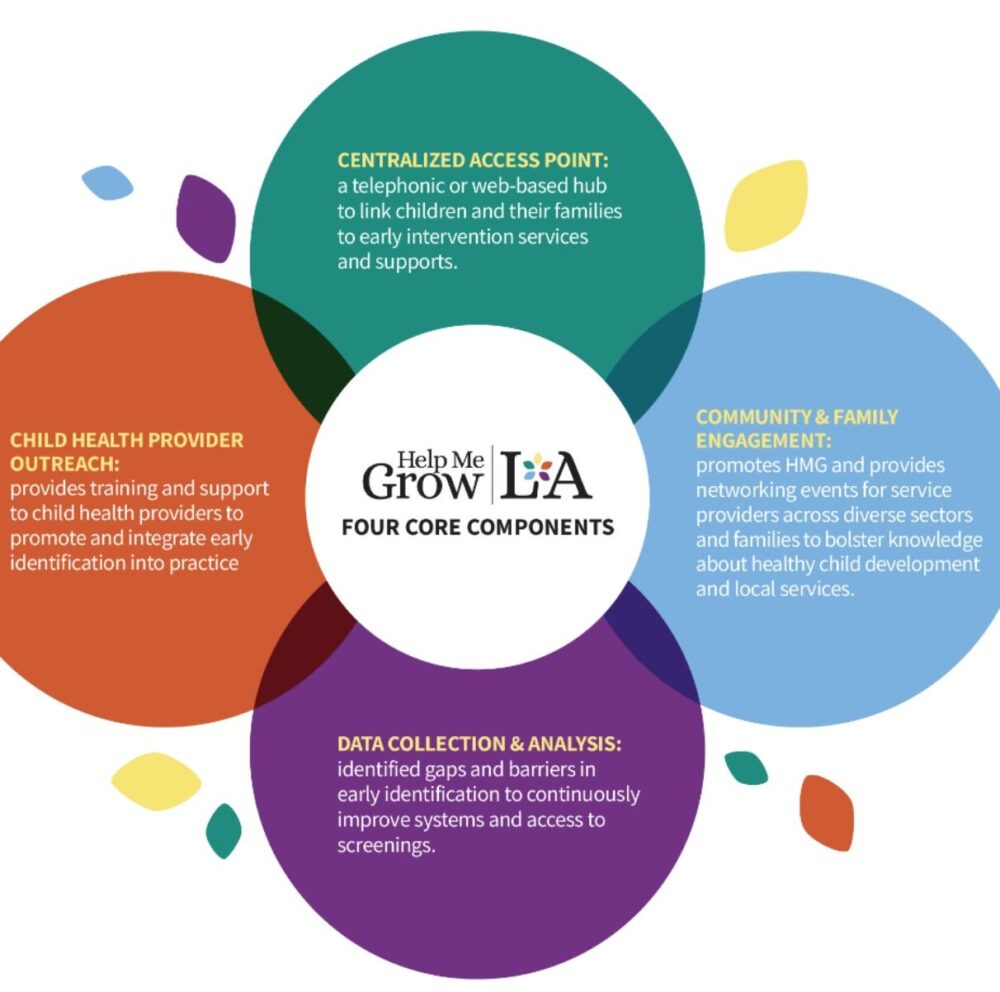

- $1.2 million ($1 million General Fund) to improve California’s statewide early intervention system, known as Early Start, through more inclusive services, streamlined intake processes and alignment, and increased collaboration between the Departments of Social Services and Education.

- $3.2 million ($2.2 million General Fund) to establish Individuals with Disabilities Education Act (IDEA) specialists at every state regional center, to provide expertise on available services and offer other technical support.

- $51 million ($31.9 General Fund) in 2022-2023 and $68.1 million ($42.6 million General Fund) ongoing to reduce regional center service coordinator caseloads to 1:40 for children through age 5.

- $10 million for Special Education supports for preschool-aged children in order to better promote inclusion in preschool for 3- and 4-year-olds served by regional centers.

- $10 million to support Early Literacy, specifically through an expanded statewide program that the California Department of Public Health and First 5 California are jointly developing to provide young children with multilingual books and early literacy programs.

- $5.5 million to support initiatives aimed at improving maternal and infant health outcomes in California, including in-depth case reviews and data collection and the publication of findings regarding pregnancy-related deaths, severe maternal morbidity and infant deaths.

Priorities aligned with First 5 LA’s long-term systems outcomes, L.A. County regional priorities, and Best Start Community Change agendas.

The proposed budget includes:

- $819.3 million ($613.5 million General Fund) in 2023-24 and $2.7 billion ($2.2 billion General Fund) annually at full implementation, inclusive of In-Home Supportive Services (IHSS) costs, to expand full-scope Med-Cal eligibility to all income-eligible adults ages 26-49 regardless of immigration status.

- $60 million to support immigrant workforce development, which includes funding for English Language Learner pilot training programs, an Employment Training Panel to expand workforce literacy, and an earn-and-learn community change career pathways program for community college students through the California Youth Leadership Corps.

- $946 million for the Greenhouse Gas Reduction Fund to address climate change and promote equity, and $1.3 million to advance racial equity and environmental justice through science, data and research.

- $291 million to continue cleanup efforts of lead contamination from the former Exide battery facility in the City of Vernon. Funding will support sampling up to 1,200 properties and cleaning up to 800 properties in 2022. Addressing environmental hazards is a priority of several Best Start communities.

- $6 billion over three years as part of a statewide plan to expand broadband infrastructure, an effort first enacted through last year’s state budget. This investment intends to increase affordability and enhance access to broadband for all Californians. The budget proposal also anticipates new last-mile project grants will be made available in 2022, utilizing both state funding from the California Advanced Services Fund and federal funds.

- $2 billion over two years to continue the state’s efforts to address homelessness by investing in behavioral health housing and encampment cleanup grants.

- $20 million ongoing to create a new refundable tax credit for young adults ages 18 through 25 who have experienced the foster care system. This proposal would provide an additional $1,000 credit to individuals who experienced the foster care system at some point at age 13 or older and who otherwise qualify for the California Earned Income Tax Credit (CalEITC).

- An expansion of the Young Child Tax Credit (YCTC), first created through the 2019 state budget, to include households with zero earned income. The January budget proposal would also index the YCTC for inflation starting in the 2022 tax year. This credit provides $1,000 to every household that otherwise qualifies for the Earned Income Tax Credit and also has a child age 5 or younger. The Franchise Tax Board estimates that about 55,000 parents would qualify for the tax credit for the first time under the proposal.

- $596 million Proposition 98 General Fund, on top of $54 million provided in the 2021 Budget Act, to fund universal access to subsidized school meals. An additional $30 million one-time General Fund to establish additional farm to school demonstration projects and $3 million ongoing General Fund to expand the regional California Farm to School Network.

Next Steps:

Newsom’s January proposal is the first step in California’s budgetary development process, laying the groundwork for negotiations between the administration and lawmakers. Now, the administration will begin developing a May Revise budget that reflects updated revenue and/or policy forecasts, while members of the Assembly and Senate Budget Committees hold hearings to develop their own budgetary priorities. Following the May Revise, the Legislature will submit its version of the budget in June. Newsom must sign the state’s finalized 2022-2023 budget by June 30. California’s new fiscal year begins on July 1.